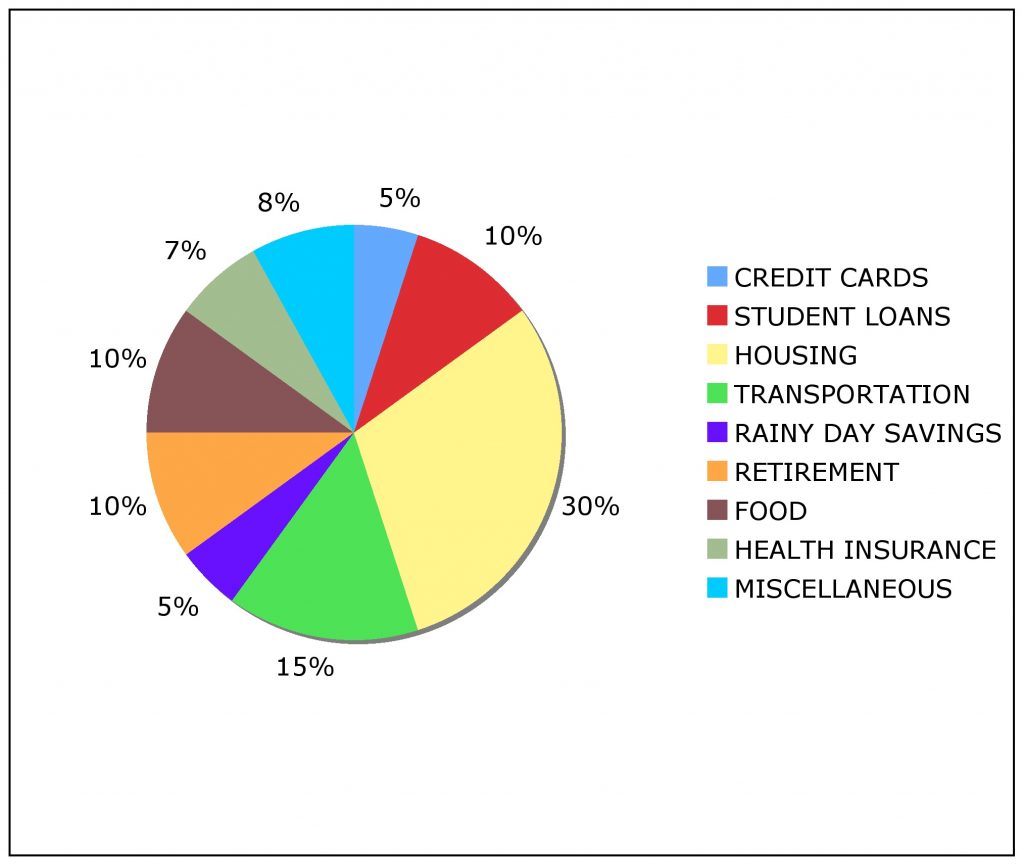

8. Cut Back on Stuff

Making sacrifices is never easy. But think about your overall financial wellness and the goals you’ve set for your savings.

Many financial planners suggest you avoid expenses such as going out for dinner frequently and buying name-brand products. So take a look at your expenses and identify where you can cut back. This doesn’t mean you have to stop treating yourself. It’s simply a matter of quantity.

If you like eating out, for example, do it once a week rather than every day.

“The No. 1 rule of setting budgets is to not cut all the fun out of your life,” said consumer-education expert Jim Tehan in an interview with BankRate. “Inevitably, Spartan budgets that have no allowance for entertainment are doomed to fail … It’s not about cutting out everything that gives you joy in life. It’s about better allocating your money.”

cbsnews.com

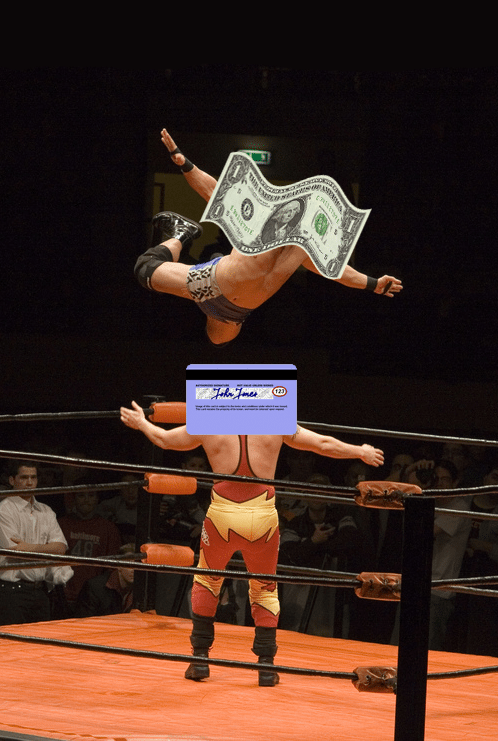

9. Avoid Using Plastic

You’ll be surprised how much easier it is to save money when you’re using cash instead of a credit or debit card. The issue with using plastic for all your transactions is that you don’t actually see your hard-earned cash disappearing. So it’s easy to swipe away and splurge without stopping to think about what you’re really losing.

According to a study by Dun & Bradstreet, people spend 12 to 18 percent more money when using credit cards as opposed to cash. So leave your card at home and set it to pay monthly bills. Withdraw a certain amount from no-fee ATMs each month to cover everything else. Afterward, put that cash in envelopes and use it for your necessities– and a little fun of course.

“By spending cash out of an envelope, you begin to get a better feeling of where your money is going and what your priorities really are,” said CFP professional Martin Siesta in an interview with BankRate.

en.wikipedia.org

![Hyundai Reveals Prototype “Iron Man” Suits [VIDEO] Hyundai Reveals Prototype “Iron Man” Suits [VIDEO]](https://suggestive.com/wp-content/uploads/2016/05/hyundai-iron-man-suit-370x297.jpg)