Most people do not get a course in school about basic life skills like banking, managing loans, and getting a mortgage. Basic banking is a huge life skill that people should know more about. Everything from basic terminology to how to write a check is important to know when you start to adult.

Getting a Bank Account

expertbeacon.com

Getting a banking account is pretty easy compared to other typical adult things, like paying off your school loans. Most banks will require you to have certain things before signing up. These things include:

- Basic information (name, address, etc.)

- Driver’s License or other acceptable proof of identity

- Social Security number

- Deposit money (banks vary on minimum amounts)

Some banks will actually let you sign up online. If not, going into the bank to create an account shouldn’t take too long to complete.

Savings vs. Checking

There are two types of accounts that you can get under your main account: checking and savings. The main difference between the two accounts is that savings accounts are meant for just that – saving. The money in your savings account will usually collect interest. Basically, the bank is paying you for having your money in there. You won’t get rich off of having your money in a bank even if you have millions in the bank. The rates are so low for most banks.

The checking account will be from where you can write paper checks. Electronic checks can be taken out of either savings or checking accounts. Most banks will give you a debit card that can be used from the checking account.

How to Write a Check

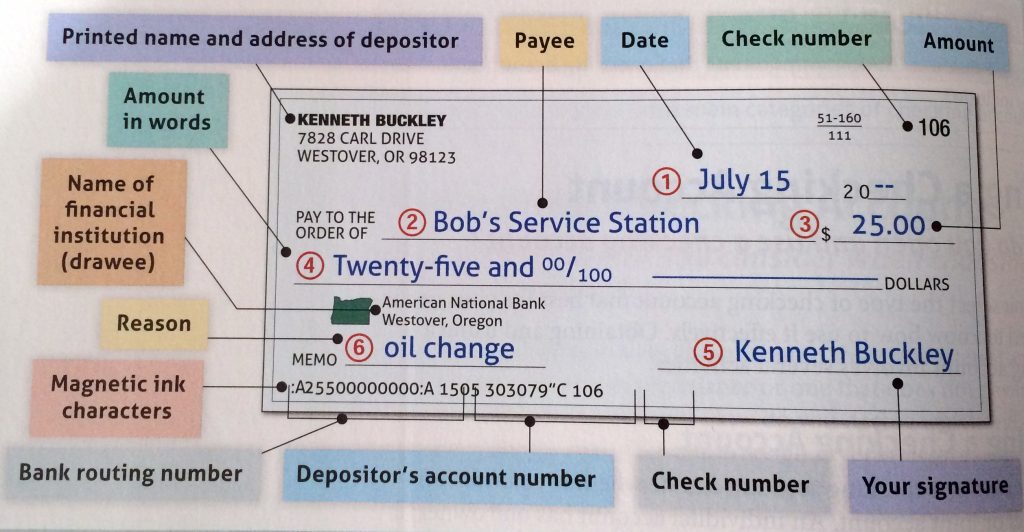

Checks are becoming more obsolete in the age where you can pay for your Starbucks order from your phone. Still, many places still prefer a paper check. You should know the basic features of a check.

- The bank routing number is the numerical number given to your specific bank. Each bank has a unique number. On every check, it will be the first group of numbers.

- Your bank account number may be different than the number you type in to log into your account. The account number is unique to your account in your bank. It is always the second number.

- When you send an e-check, it will ask for your routing and account numbers.

- Make sure you sign your check at the bottom right.

- When cashing or depositing a check, make sure that you sign the back and write your account number on it for your bank.

- It is not necessary to fill in the “Memo” section on the bottom left. That is more for your records or so that the check recipient knows what the money is for.

- The line after the cents in the picture below is to prevent anyone from adding more numbers into your check.

sites.google.com

What are Overdraft Fees?

Each bank will have fees for over drafting your account. You would think that banks wouldn’t take out more money than what is in your account, but they do. If you make payments that total more than what is in your checking account, then your bank will charge you a fee. After you put money into your account, your bank will then deduct the fee from your money. With mobile apps available for many banks, try to keep up with your balances to make sure that you do not get an overdraft fee.

Minimum Balances

refe99.com

Even if you have a checking account, that doesn’t mean that it is free. Some banks do not offer free checking. This means that you have a minimum balance that you have to maintain. Dropping below the minimum (say 100 dollars) means that your bank will take a fee out of your account. Sometimes, it will be a certain amount for each day that you are below the minimum. If you know that you are likely to drop below the minimum in-between pay checks, look for banks that offer free checking.

Extra Miscellaneous Banking Fees

bcslko.com

Banks should be completely transparent about what fees they charge you for your basic accounts. Fees could include ATM withdrawals if you do not use your bank’s ATM kiosks. Some fees could include:

- Overdraft

- Dipping under your minimum balance

- Fees for too many debit withdrawals in a month.

- Fees to order a box of checks

- Monthly maintenance fees (fees charged per month. Watch out for these)

- Fees to transfer money between accounts or wire transfers

- Paying bills through online banking