6. Build a Debt-Payment Plan

Mounting debt can take a catastrophic toll on your financial wellness if it’s not addressed properly. Consider taking a thorough look at your debt, earnings and savings to come up with a plan for tackling debt.

First, aim for high-interest debt such as credit card payments. The latest BankRate data puts the average fixed-interest rate for credit cards at 11.6 percent. Using the latest records from the U.S. Census Bureau and the Federal Reserve, ValuePenguin.com reported that the average credit card debt for American households is $5,700.

So tackle this debt sooner than later. One way to do it is to set small goals over time. For example, you may find that you can pay off one credit card by a certain month if you cut back on some unnecessary expenses.

flickr.com

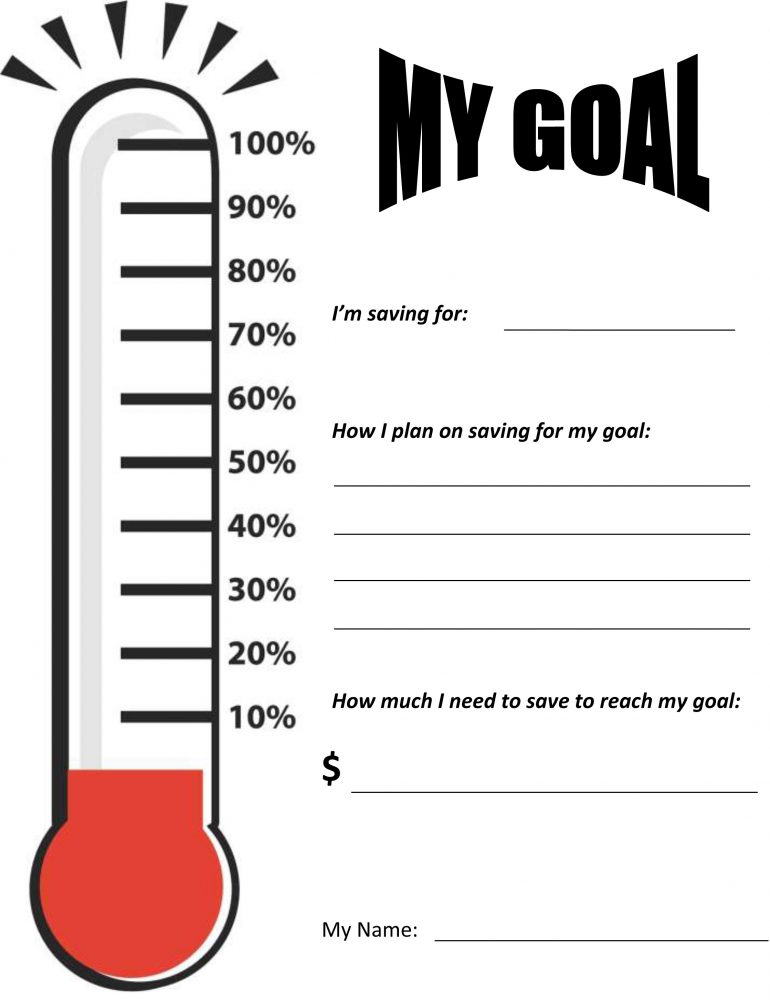

7. Set Your Goals In Front of You

Studies show that saving money is a lot easier when you have set financial goals to reach. So always keep your eye on the prize. Think of at least three major goals you want to accomplish with your savings. Jot them down on index cards or store them on your phone. Just make sure they’re always accessible.

When you feel tempted to splurge, look back at these and think about how that spending will affect your goals. Every Time you make money, think about how closer you’re getting to meeting these milestones.

Each goal should follow the S.M.A.R.T. criteria (Specific, Measurable, Attainable, Realistic, Time Oriented).